Hey there, fellow shoe lovers! Today we’re going to dive into the world of orthopedic shoes and, more specifically, insurance coverage for these often life-changing accessories. You might think, “Orthopedic shoes? That sounds like something only your grandma would need.” But hold your horses! These comfy wonders can mean the world to anyone with foot, ankle, or lower limb issues, and insurance makes them much more accessible. So, let’s get into the nitty-gritty of how you can get your orthopedic shoes covered by insurance.

Read Now : High-quality Office Loafers Durability

Understanding Insurance Coverage for Orthopedic Shoes

First off, it’s super important to know that insurance coverage for orthopedic shoes varies widely. Some plans cover them fully, while others might only foot part of the bill (pun totally intended!). Generally, insurers require a prescription from a healthcare provider, which might seem like a bit of a hassle but is a fair deal if it means you get some or most of your shoe cost back. Remember, it’s not just any shoe—orthopedic shoes are a form of medical equipment. Legit, right? Your doc will assess your particular needs and write that all-important prescription. Once you have it, navigating the insurance world becomes a bit more grounded. Whether it’s bunions, plantar fasciitis, or a whole buffet of foot ailments that bug you, having insurance coverage for orthopedic shoes can save your feet and wallet from unnecessary suffering.

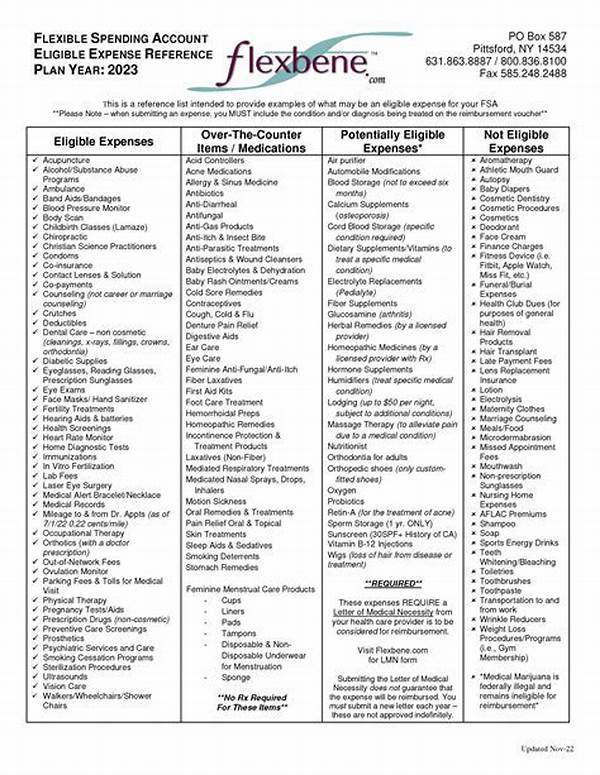

What’s interesting is that some insurance plans offer partial reimbursements for custom-made orthotic inserts too. So, it’s not just about whole shoes but parts of them. This coverage is crucial for those with very specific medical conditions that demand custom solutions. Now, before you run to the nearest shoe store, take a breather and check with your insurance provider for the specifics. Each plan has its quirks and may require different steps, but hey, getting that coverage means you can strut in comfort without that financial sting.

Steps to Secure Insurance Coverage

1. Prescription First: Insurance coverage for orthopedic shoes often requires a healthcare prescription as a first step.

2. Know Your Plan: Different insurance plans offer varying degrees of coverage, so become a plan detective!

3. Receipts Matter: Keep all your receipts—insurance will want them as proof for any reimbursement claims.

4. Custom vs. Off-the-Shelf: Some insurance plans are picky about covering custom shoes versus ready-made ones. Check what’s allowed.

5. Appeals are Possible: If you’re denied coverage initially, don’t fret. Filing an appeal can sometimes sway the decision in your favor.

Decoding the Fine Print of Insurance Policies

Let’s be real, insurance jargon can often feel like it’s written in another language. The fine print of insurance coverage for orthopedic shoes can reveal nuances you don’t want to overlook. For instance, some policies might define “medical necessity” in a way you hadn’t expected, making it crucial to gather the right documentation. Another sticky point can be annual caps—some plans have a limit on how much they will pay for orthopedic solutions within a year. There’s also sometimes a differentiation between a foot orthosis and an actual shoe, so attention to detail is vital. Trying to wade through this information is a challenge, but patience and a bit of snooping can provide clarity.

When navigating these waters, remember that your insurance company is obligated to provide you with all the necessary information, so don’t hesitate to get on a call and ask all the questions you need. Often, speaking to a human can make a foggy process seem a lot clearer. Knowledge is power, baby, and once you’re equipped with all the info, securing insurance coverage for orthopedic shoes becomes a much more manageable task.

How Insurance Providers Determine Coverage Eligibility

Insurance providers typically have a specific criterion for determining eligibility for covering orthopedic shoes. The process might seem daunting but, fortunately, generally follows a straightforward route. Essentially, insurance companies will look for documented medical necessity. They’ll want to see that your need for orthopedic shoes isn’t just about luxury or preference, but a genuine health requirement. This usually involves a doctor’s examination and a written prescription stating you need orthopedic shoes to improve your wellbeing or mitigate foot-related issues. Pretty reasonable, right?

Additionally, insurance coverage for orthopedic shoes might hinge on your medical history and any previous treatments. If you’ve tried other therapies or products without success, insurance may be more inclined to approve coverage. Whether your condition is congenital or acquired later in life can also affect decisions. Likewise, your plan might have a set list of eligible conditions that qualify for orthopedic shoes, so understanding your plan’s specifics comes in handy yet again. In a nutshell, eligibility is a mix of medical need and insurance specifics—so get that checklist in order, folks!

Common Misconceptions about Insurance for Orthopedic Shoes

Our world is full of myths and misconceptions, and insurance coverage for orthopedic shoes is no stranger to them. Here are some nuggets to be aware of:

1. Age Factor: It’s not just for seniors! All ages might be covered if there’s medical documentation.

2. Cost Assumptions: Some think insurance covers the total cost, but often it’s only partial.

3. One-Size-Fits-All: Orthopedic shoes covered by insurance are tailored to medical needs, not just regular shoes mistakenly thought to be covered.

4. Replacement Limits: Insurance won’t pay for new shoes every single year; limits exist.

5. Prescription Permanence: Some assume a prescription is a one-time deal. Actually, it may need regular updates.

Read Now : Essential Documentation For Insurance Claims

6. Immediate Approval: Coverage requests can take time for approval—patience is a virtue.

7. Doctor Recommendations: Not every doctor’s recommendation translates to insurance approval.

8. Free Inserts: Insurance coverage might extend to inserts, but again, specifics matter!

9. Online Confusion: Just because a website says “insurance-ready,” it needs verification.

10. Appeal Phobia: Folks sometimes avoid appealing denied claims, but it’s a valid and sometimes rewarding move.

The Financial Aspect of Orthopedic Shoes

Let’s chat about dollars and cents, my friends! The financial aspect of insurance coverage for orthopedic shoes is crucial. These shoes can be pricey—sometimes shockingly so. If insurance steps in and picks up part of the tab, that’s a big win. Normally, insurance plans have a deductible you must meet before they start covering significant costs. It’s common for insurance to cover between 50-80% of orthopedic-related costs, but of course, this varies as widely as shoe styles do.

Co-pays may still leave some financial weight on your shoulders, so supply your insurance company with all required documents to prevent any premium hiccups. Also, let’s not forget about out-of-network restrictions. If your shoe provider isn’t within your insurance’s network, well, costs might skyrocket. Being proactive about these elements can make wearing orthopedic shoes as comfortable financially as it is physically.

Finally, don’t overlook potential tax deductions! Sometimes medical expenses, including insurance-covered orthopedic shoes, can be deducted if they meet a certain threshold of your income. Every little bit helps, right? So document everything and maybe consult a tax professional to see if your shoes might save you other expenses.

The Role of Physicians in the Insurance Process

When it comes to securing insurance coverage for orthopedic shoes, physicians play a pivotal role. Their detailed examination and resulting prescription provide the foundation upon which your insurance claim is built. Skilled in identifying the specific needs of your feet, a physician’s input can often make or break your case. Their paperwork usually includes details like the diagnosis, treatment plan, and the reasons that make orthopedic shoes a necessary medical intervention for you. It’s your physician’s expert opinion that translates your needs into insurance terms.

Furthermore, because some insurance providers require ongoing proof of need for coverages like this, your physician remains a partner in the long haul. They might periodically update prescriptions or provide additional evidence if an initial claim hits a snag, ensuring your feet remain well-dressed and well-protected with minimal out-of-pocket costs.

Working closely with your physician and maintaining open communication can guide you through the labyrinth of insurance needs and claims. So, a shout-out to the doctors helping us keep our feet comfy, one prescription at a time!

What to Do If Insurance Denies Your Claim

Insurance denial can feel like hitting a brick wall, but it’s not the end of the road when it comes to insurance coverage for orthopedic shoes. Start by reviewing the denial letter closely—you’d be surprised how often small documentation errors cause big issues. Next, reach back out to your healthcare provider. They can often provide additional information or clarification that may sway the insurance company’s decision. Don’t hesitate to ask your doctor to communicate directly with your insurer if specifics about your condition are required.

Moreover, gather any medical history or previous unsuccessful treatments you’ve had, showing that other routes have been ineffective. Let’s not forget the appeals process, folks! It’s an avenue worth exploring if your initial claim is rejected. Many people assume a denial is final, but multiple appeals can occasionally yield success. Consult your insurance policy to understand the appeal timeline and necessary steps. Insurance companies can be notorious for red-tape bureaucracy, so persistence often pays off. Be patient, thorough, and proactive in following up on your claim status. The end goal of comfy feet at a fraction of the cost is worth the effort.

There you have it, a comprehensive guide that hopefully gets you one step closer to snagging insurance coverage for orthopedic shoes. Remember, it’s all about being informed, prepared, and patient. Happy shoe hunting!