Hello, shoe enthusiasts and comfort seekers! If you’ve ever found yourself in a tangled web of foot problems and medical bills, you know that comfort isn’t just a luxury—it’s a necessity. That’s where orthopedic shoes come in, and the good news is some of them might be covered by insurance. Let’s dive in!

Read Now : Best Winter-proof Anti-slip Footwear

Why Choose Orthopedic Shoes Covered by Insurance?

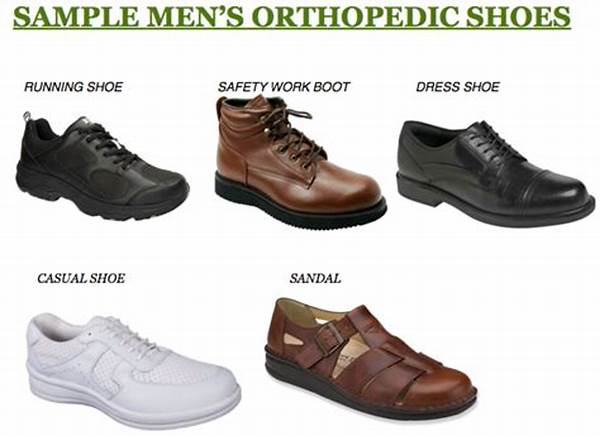

First off, let’s chat about why orthopedic shoes are a big deal. They’re not just any shoes; they’re designed to provide support where you need it most—perfect for those with chronic foot pain, plantar fasciitis, or diabetes. Best part? You might be able to snag a pair without emptying your wallet! Orthopedic shoes covered by insurance can make a huge difference in both your foot health and your finances. All you need to do is figure out the hoops to jump through, which we’ll touch on more in a bit.

Also, it’s not just about alleviating pain. These shoes can improve your overall quality of life, keeping you mobile and active without the nagging discomfort. It’s like having a personal foot masseuse on hand, minus the spa charges!

Let’s face it: navigating insurance policies can be as tricky as assembling IKEA furniture without instructions. Many standard health insurance plans, including Medicare, do offer partial coverage for these shoes, but specifics can vary. So, grab a cup of coffee as we unravel these details together.

Steps to Get Orthopedic Shoes Covered by Insurance

1. Check Your Insurance Plan: First step is to give a thorough read to your insurance policy or directly contact them about orthopedic shoes covered by insurance specifics.

2. Doctor’s Prescription: A prescription is often needed. Consult with your healthcare provider to recommend orthopedic shoes as a medical requirement.

3. Get a Custom Fit: Many insurance policies require that the shoes be custom-made or specifically fitted by a certified orthotist.

4. Submit the Paperwork: Prepare to fill out forms. Lots of them. Insurance companies thrive on paperwork!

5. Stay in Network: Make sure you purchase the shoes from an insurer-approved vendor to ensure coverage.

The Pros and Cons of Orthopedic Shoes Covered by Insurance

Deciding on orthopedic shoes covered by insurance comes with its own set of pros and cons, much like choosing between Netflix or Hulu for your binge-watching sessions.

Let’s start with the perks. First up, the financial savings can be a breath of fresh air when you’re dealing with medical costs. Imagine maintaining your foot health without adding stress to your budget. Also, with insurance covering part of the payment, it frees you up to choose higher quality options.

On the flip side, the approval process might test your patience. From getting a doctor’s prescription to ensuring compliance with insurance policies, it could feel like you’re jumping through hoops. Plus, not every stylish option is eligible for coverage, which could limit your choices if you’re fashion-conscious.

Understanding the Insurance Lingo

To many of us, insurance terms might as well be another language. Here’s a little crash course to help you decode the jargon when looking for orthopedic shoes covered by insurance.

Read Now : Elegantly Designed Functional Shoes

For starters, “durable medical equipment” is a term you’ll come across. You’ll also want to familiarize yourself with terms like “premium,” “deductible,” and “copayment.” Knowing these can make a world of difference when you’re reading your policy.

You’ll typically need a “Certificate of Medical Necessity,” which is a fancy way of saying “a note from your doctor.” This certificate is crucial in proving you truly need those orthopedic shoes to stay comfortable and healthy.

Real Stories of Orthopedic Shoes Covered by Insurance

You’re not going through this alone; many have walked the same path—literally.

One reader, Jane Doe, shared her experience of wading through piles of paperwork to have her insurance cover her orthopedic shoes. “It was worth every call and form,” she said. “My feet have never been happier, and neither has my bank account.”

Another fellow, John Smith, talked about the satisfaction of feeling like he’s walking on clouds ever since he secured orthopedic shoes covered by insurance. He emphasized, “The key is fighting for what you know you need. Don’t let the paperwork intimidate you.”

How to Maximize Your Benefits

So you want to make sure you’re squeezing every benefit out of your insurance plan when it comes to orthopedic footwear? Here’s a quick guide.

First, always keep open communication with both your healthcare provider and insurer. Transparency is key. Also, ensure to file claims as soon as possible and keep copies of all your paperwork just in case. More importantly, stay informed—insurance plans change, after all!

Finally, don’t hesitate to appeal if your initial claim gets denied. There are often overlooked options available, and persistence can pay off when seeking orthopedic shoes covered by insurance.

Conclusion: Orthopedic Shoes Covered by Insurance

Stepping out in style and comfort doesn’t have to drain your bank. With a bit of diligence and patience, orthopedic shoes covered by insurance can become a reality. So go ahead, give those feet the love they deserve, all while keeping your budget intact.

In conclusion, remember it’s all about understanding your needs, working closely with your doctor, and wading through the insurance waters without sinking. Just like life, it’s a journey—one step at a time. Happy walking!